Pricing is strictly a matter of value perception, which is why you can have guys like Tony Robbins charge a million dollars a year to work with him one-on-one as a personal coach – when the average life coach makes $35.00 an hour.

It’s also why you have companies like Zappos, who refuses to compete on price, and yet, has gone on to become a multibillion dollar company.

…And why undifferentiated goods (like oil) are bought and sold on big commodity exchanges for the lowest price possible.

Focus on your Unique Advantage Point and use the position strategies outlined throughout this blog – as well as inside of The Predictable Profits Playbook – to create an advantage, making your competition irrelevant.

Then, price comparison becomes less important.

For example, technology is becoming commoditized as many phones, computers, tablets, etc. have similar features. However, Apple makes it a point to differentiate themselves. As a result, they don’t compete on price, and its retail stores earn more sales per square foot in the US than any other retailer. (Source)

You don’t need to compete on price to be competitive.

Understand this key point: the more commoditized your business, the more price becomes an issue. The more differentiated you make yourself, the less price is an issue.

This goes for B2B and B2C businesses…

In fact, when entrepreneurs tell me, “I have to lower my prices to compete,” I know right away – like a doctor diagnosing an illness – that the symptom appears to be price competition, but the real issue is competitive differentiation.

If you’d like some insights on estimating what your business is worth, check out this related piece on how to value a business.

Look, if you take one thing from this article, let it be this:

Do Not Use Price As Your Competitive Advantage

The Predictable Profits Methodology takes an opposite approach:

“What needs to happen in order for you to be the most expensive competitor in your industry and still have clients lined up to do business with you?”

So today, you’ll discover the:

- Imminent business death resulting from not raising your prices

- Dangers of being the cheapest competitor

- Suggestions for increasing your prices without losing a customer

For many entrepreneurs, the only thing more frightening than losing money is the idea of raising prices. Why?

Because it’s often perceived that customers and clients are more likely to do business with you if you have low prices, not higher prices.

That’s why so many business owners issue coupons, have sales, and use discounts as incentives to get you to buy…

And yes, there are some price sensitive customers, but the point is that to survive and thrive in business, you customers must want to do business with you because they see the value you bring to the table. You don’t want the only reason to come down to price.

^ Read that sentence again. ^

Discounting is a temporary fix. It’s a sprint for quick cash, but the utility of this strategy burns out quick…

And actually works against the long term growth of your company (we’ll cover this in more detail later).

Competing on price is a race to the bottom. I’ll prove it to you…

For example, when is the last time you raised your prices? Have you resisted because you feared you would lose a customer or client? Would you be surprised to learn that if you haven’t raised your prices in the last 5 years, your business is becoming less and less profitable every year?

It’s the scary truth many entrepreneurs ignore…

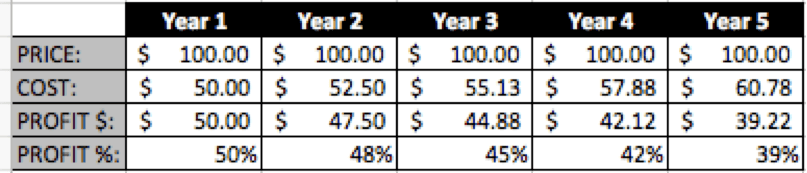

For example, let’s pretend you have a widget that costs $100 – and you’ve been selling that widget for $100 every year for the last 5 years (for the sake of clarification, this widget may be a product or a service, it really doesn’t matter for this illustration).

Five years ago, at the price of $100, you calculated a whopping 50% margin – so you’re making $50 on every unit sold. Pretty good, right?

Unfortunately, costs go up… Energy prices fluctuate, employees require raises, overhead (like rent) goes up, etc., so it’s reasonable to estimate that costs can go up by 5% a year (often more), right?

Let’s look at the impact the decision of maintaining a $100 price point has had on your business.

By year 5, you’re making 22% less money per sale than you were making on year 1, and that’s only with a 5% increase in costs…

How long can you keep this up?

Oh, but it gets worse…

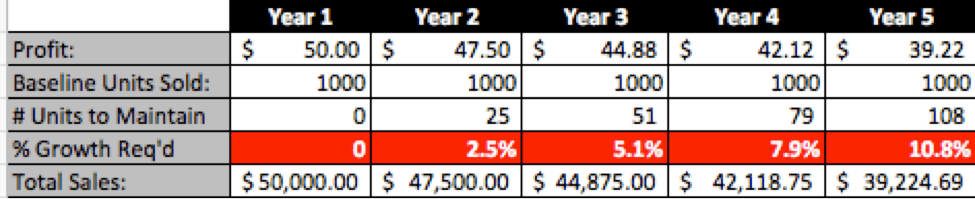

That means if you’re selling 1,000 units a year, in order to maintain your profit level year-after-year, by year 5 you have to grow your business by 10.8% just to make the same amount of money you did in year 1!

That’s sort of like stashing $100k under your mattress and thinking that you always have $100k. In real dollars… You don’t.

Without putting it back in your business, in the stock market, or even in the bank to work for you – you’re losing money every year by not earning a return on that, at a minimum, keeps up with the Consumer Price Index.

Raising prices is critical to growing a business, and if you’re discounting the “same” price year-after-year, you’re losing even more.

We’ll get into a few strategies for raising your prices, but first, let’s go into more detail about the pitfalls of competing on price.

Setting suitable objectives and identifying strategies or opportunities are vital to growing a business. Nevertheless, you must turn your ideas into actions to achieve your end goals. Read about tactical planning in this related piece.

#1 – YOU CAN’T STAY AT THE TOP WITH LOW PRICES

If you’ve been with me for a while, you know that there’s never been a company that’s maintained their position as a low cost competitor and survived.

All we have to do is look at history for proof.

Let’s face it, before Walmart, there was K-mart. Before K-mart, there was Ames. Before Ames, there was Woolworth. Before Woolworth’s, there was an ever-changing cast of regional discount retailers.

And just in case you think that Walmart is immune, a survey done by WSL Strategic Retail a couple of years ago that found that 86% of shoppers no longer believe that Walmart has the lowest prices.

Clearly, you don’t shop at Walmart for an awesome experience or the fanatical customer support. Right? So, if Walmart doesn’t have the lowest prices, why would anyone continue to shop there?

If your sales are based on price, and you’re no longer perceived as the cheapest, your customers and clients will drop you the moment they find someone willing to offer a lower price.

With permanently low labor costs in places like China and India, there’s always going to be somebody who’s going to come up with something at a cheaper price. There are a million less expensive alternatives. There are a million different ways somebody can cut corners.

There’s always going to be somebody cheaper, so it’s an unsustainable way to do business to use price as your main competitive advantage.

[inf_infusionsoft_inline optin_id=”optin_1″]

#2 – PRICES AND VAUE PERCEPTION COME HAND-IN-HAND

As consumers, you’re led to believe higher prices equate to higher quality.

Think about it – Rolex vs. Timex; Mercedes vs. Hyundai; Nordstrom vs. JC Penney… In each instance, we’re programed to believe the higher priced product is of higher quality.

That’s why many consumers – when shopping for an item off the shelves – will compare prices, and without any prior knowledge of the product, have a perceived knowledge of which one is better quality.

“A rose by any other name might smell as sweet, but slap on a hefty price tag, and our opinion of it might go through the roof.” – Kathy Svitil, Caltech

And not only is it perceived that the quality is higher – it actually has been proven to impact the experience of the user.

Consider this study by Caltech:

“Antonio Rangel, an associate professor of economics at Caltech, and his colleagues found that changes in the stated price of a sampled wine influenced not only how good volunteers thought it tasted, but the activity of a brain region that is involved in our experience of pleasure. In other words, ‘prices, by themselves, affect activity in an area of the brain that is thought to encode the experienced pleasantness of an experience,’ Rangel says.”

(See more here)

My wife and I are buying a new television. Because we keep our TVs for years, we want the best.

However, technological advancement is at such a level now, it’s hard for the everyday consumer to know the difference between one feature and another. So, to the untrained eye, it’s becoming increasingly difficult to know which TV is best. We (ignorantly) figure more expensive “must” equal better quality.

Sure, it sounds crazy, but that’s just the way consumers think…

The average Starbucks coffee goes for about $4.50 a cup. Do you think Starbucks has one of the better tasting coffees?

Think again…

A few years ago, Starbucks ranked last in a blind taste test behind Folgers. I mean, come on…

Folgers is a cheap grocery store type of coffee and Starbucks is ranked last!

Why are we spending $4.50 on a cup of Starbucks coffee when it doesn’t taste nearly as good as a cup of Folgers?

Because we believe it tastes better. Perception is everything.

Time Magazine has an article. No joke – Walmart coffee tastes just as good as Starbucks. Walmart coffee! You’re paying twice as much money for Starbucks.

Again, price and value perception go hand-in-hand.

A friend forwarded me a link to a business coach who sells an entire year of business coaching for less money than it costs for just one month to work with me.

Now, this guy is 1/12 the price I charge, but if you didn’t know me and you had to place a bet on who was most likely to deliver a greater result to you, would you put your money on the guy who’s pathetically inexpensive or the one requiring a premium investment?

Look, as momma always says: “You get what you pay for…”

Cheaper doesn’t mean better.

#3 – LOW PRICES MAKE IT HARDER TO COMPETE

It’s simple math.

When you’ve lowered your prices to a point where it really starts to hit your margins, that’s less money you can invest in customer retention. That’s less money you can invest in customer acquisition. That’s less money you can invest in keeping your customers happy.

Marketing legend Dan Kennedy is famous for saying:

“Ultimately, the business that can spend

the most to acquire a customer

wins.”

The opposite also holds true…

Look, you don’t go to Walmart expecting an extraordinary experience, right? Yet, you pay more money at Nordstrom and would expect it…

When I was in my early 20s, I worked with an accountant who charged $97 an hour… Being naïve, I assumed all accountants provided a similar benefit.

Knowing what I know now, it was unreasonable for me to think he was going to save me the same amount of money that my account does now (who charges multiples more than that).

(Side note: it was through the hard knocks that I learned what my professors at Babson meant when they said, “Never skimp on accountants and lawyers – you get what you pay for.”)

Understand that when your customers are coming to you solely because of price, they’ll drop you like a dime the moment they find anybody cheaper. They’re the lowest source of customer referrals and the biggest source of headaches and poor customer experience.

Discounting has a purpose and a use. You can use it as an incentive to get them to start doing business with you (introductory pricing)… You can use it to reengage old customers… To provide a token of gratitude to your most loyal customers….

You can also use these tactics to encourage larger purchases – for example, volume discounts: the more you buy or the longer your contract, the bigger the discount.

Discounts can be used to introduce new products or service to encourage early buyers.

…Or to sell out-of-season, overstocked items.

Discounts can also be used as an incentive to renew contracts early (before the expiration date).

If you’re using a discount, make sure you have a reason for the discount that makes sense to your customer or clients.

So yes, there are uses and advantages for using discounts, but what about the dangers?

Marketing author Laura Ries says it perfectly:

“The effects of coupons, sales, and discounts are exactly the same as cocaine. The first time you get a discount card in the mail, you are elated! WOW! 10% off, 20% off, 2-for-1! You might rush out to the store and take advantage of the offer, but next time you drive by that store you think, I’ll just wait and see if there are any more coupons coming. Next time you drive by that store you get mad since you forgot the coupon. Eventually, you refuse to step into the store without a coupon.”

[inf_infusionsoft_inline optin_id=”optin_1″]

…And that’s the problem with offering discounts too frequently and without reason.

For example, my wife and I get coupons like the one below nearly every week:

How much value do you think these have after a while? Not much, right? (It’s just like Laura says).

Of course, lowering your prices isn’t guaranteed to bring in more customers either. In fact, I’ve had vendors come to me and tell me: “I’ll beat any of my competitors pricing.”

Sounds great when there’s just one vendor saying it… However, I had two competitors promising the same thing – then it became a race to the bottom.

I also talked with a sales rep for one of the most recognizable marketing names in the business. They offer sales on their products and services nearly every week. Their sales rep told me this strategy worked great in the beginning, but now they’re suffering from a lack of sales – because if they’re not offering a sale on the product, no one wants to purchase.

“Shoppers find unlimited inventories online, so they no longer worry about missing out if they don’t buy an item in the store right now.

So how can average retailers fight back?

Here’s the first tip: Low prices alone won’t do it.

So if you’re not the biggest player in your space, what potential advantages do you have?

Three things: loyalty, convenience, and price.”

– GOOGLE ZMOT

So, now you might be wondering… How do we raise our prices?

Here are a few strategies to get the juices flowing:

Introduce Payment Plans

Todd Niemaszyk of Atlantic Builders charges premium prices as a general contractor for commercial and industrial projects. In addition to exceptional service and quality, Todd told me he often wins the bid (even if he’s the highest) because he offers his clients a convenient way to pay for his services.

Rather than a client going through the hassle of getting a bank loan, Todd says he will finance a portion of the contract for terms favorable to the client. So, Todd makes money on the loan interest, is able to charge premium prices, and the clients are smiling ear-to-ear having just had a wonderful experience.

It’s a competitive advantage for Todd that has allowed him to grow his business every single year for the last decade.

Ever watch an infomercial? There’s a reason why they just don’t sell you on a $200 item, and instead pitch it as “4 easy payments of $49.95.”

Consider a payment plan as a way to make paying for your services more attractive and easier for your customers.

Offer Coupons/Rebates After Raising Prices

The other day, I was in Best Buy looking at tablets – and I noticed they showed the price of the product and the price after rebates.

Brilliant.

It read something like:

Price: $499.00

Rebate: -$50.00

PRICE AFTER REBATE: $449

From a perception standpoint, I felt I was only paying $449 – even though when I went to the cash register, I had to pay $499 and mail the rebate in order to get the $50.

You see, if you raise your prices, you can offer a coupon or rebate for those price sensitive customers to lower both the investment and the perceived investment.

You’ll be surprised at how many sales you’ll see as a result of offering a rebate – and how few rebates are actually requested. According to a friend of mine who manages rebates for many of the leading brands, more than 40-60% of rebates are never actually claimed.

Explain Why Your Prices Are Increasing

Poland Springs increased my prices on my monthly delivery of spring water – but rather than simply raising their prices, I received a pleasant notice from an executive of the company explaining the increase in gas prices resulted in their unfortunate need to raise their price.

This “reason why” was enough for me to agree to the increase without any resistance. I got it. It made sense.

I once had a contractor who raised his prices by 25%, costing me tens of thousands of dollars or more over the course of a year – but he explained to me that he was reinvesting in higher quality products and offering 24-hour support to provide a better experience for my customers and less hassle for me. It seemed logical and I desired the benefit, so I agreed.

If you have to raise your prices, give your customers the benefit of the doubt and explain to them, in a truthful and logical way, why you need to raise the prices – either because of situations beyond your control (i.e., gas prices), or to provide them with a better service.

Better Guarantee/Outstanding Service

Similar to “Reasons Why” – when you offer a better guarantee, just like Zappos, people will pay more for accepting less risk.

People want peace of mind.

Not only do Nordstrom and L.L. Bean offer great products – there’s also no time limit, no receipt required, and no paperwork to return any item you ever purchase there.

Zappos offers free return shipping for a full 365 days.

We raised one of my client’s products up 25% with one major difference: we told everyone they had a 100% Money Back Performance Guarantee, PLUS an extra $500 if the product didn’t perform as described. The result was an immediate increase in both sales and profits, putting him as one of the most expensive (and successful) competitors in the industry.

I had a gentleman from a central vacuum cleaner company here to replace the unit in our house. His price is more expensive than most… However, he said his work is guaranteed for 5 years, and if we have any problem whatsoever, he’ll service our equipment at no cost, and within 24 hours.

None of his competitors offered us this benefit.

Create Packages

There’s a subset of people who will always buy the most expensive offering to satisfy ego, peace of mind, and/or wanting a better result…

While there are others who simply want a very basic model, and are willing for forego the bells and whistles for a cheaper price.

So give people what they want – create multiple, different packages!

…A basic model and a premium model.

You see this in the car industry. You can buy your CLA-Class, C-Class, E-Class, CLS-Class, CL-Class, or your SLS-Class Mercedes coupe, ranging anywhere from $29,900 for your most basic model, all the way to $201,500 for the premium option.

Give people choices.

Bundle With Premiums

You can also raise your prices by bundling your existing product/service with a high profit and desirable premium or bonus.

I took part in a Crossfit competition where they increased their admittance fee by almost double, but you got a free meal and t-shirt.

I have a client who sells an information product for a premium price, and as a bonus, offers free software to people who purchase.

People will often buy products based on a desired premium. Bundle it together and you’ve created a higher perceived value, warranting additional price.

Now remember, there’s no such thing as a marketing magic wand. I can provide you with the best tools and information, but it’s up to you to test, test, and test.

Explain The Value

Illustrate, demonstrate, and articulate the unique value your product and company brings to the table – and how it’s superior to the competition.

Walter Bergeron, founder of Power Control Services (a circuit board repair business), charges 35% more than his competitors.

How?

Because in addition to quality service, he offers a loaner so the equipment can remain online and operative while it’s being repaired… Fast turnaround time… And assurance that customers will never have to pay for that type of repair on that piece of equipment ever again.

Professor Drozdenko, chair of Ancell School of Business Marketing at Western Connecticut State University, says:

“When consumers have more information about a product, such as past experience, consumer report ratings, information from peers, etc., then the price becomes a less important factor in the decision process.”

And here are 11 more approaches my clients have found helpful, as also discussed in my book, The Predictable Profits Playbook:

1. Break your service down into component parts, and charge for each component (if this creates a margin advantage).

2. Add a parallel service or product at a high margin that increases the value of the original service or product.

3. Create a premium package of products or services, and offer it as a high-value alternative (but only if it creates a margin advantage).

4. Offer upgrades to your products or services.

5. Offer consulting around a product to help customers gain maximum value.

6. Establish the return on investment (ROI) so clients can see the cost as a small percentage of the value received.

7. Reposition a slightly updated version to a luxury or higher value category (e.g., go from mid-range up one level).

8. Test new pricing strategies on various market segments and optimize those that promise the best results.

9. Reposition the selling point in your advertising so that, rather than selling a product or service, you’re selling security.

10. Increase your price to the next psychological hurdle (e.g., $8 to $8.99 per unit or $120 per hour to $125).

11. Offer a low introductory price (e.g., basic cable TV service at $24.60 a month), then escalate the price for additional or premium-level services (e.g., premium cable TV for $127.40 a month).

Find a way to remove price from the buying equation so people are happy to do business with you (even if you’re more expensive), and you’ll build a competitive stronghold your competition will envy.